The Value of Getting Things Right the First Time

Whether you’re an AMC, a lender, a credit union, or an appraiser, understanding the importance and value of having a modern QC system in place is essential to helping your business run smoothly. Reduce report turn-around-times drastically by eliminating the need for multiple rounds of revisions, and for appraisers, you can significantly improve your reputation and brand yourself as someone who does their due diligence.

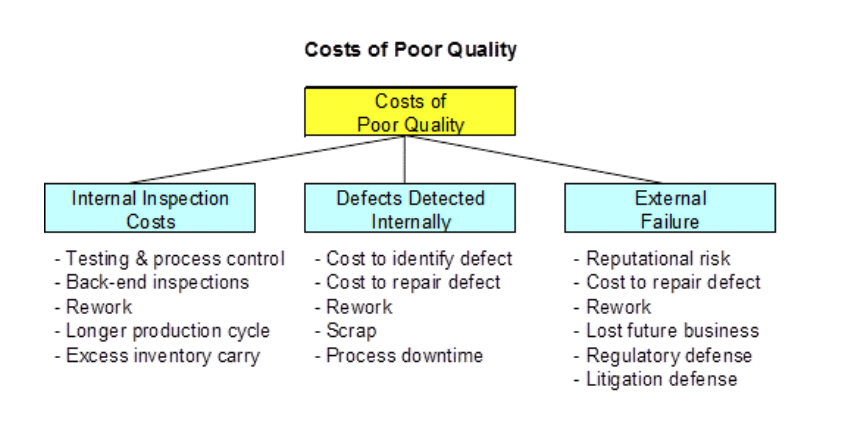

As stated in a presentation from Appraisal Institute, having to go through even one or two rounds of revisions is simply frustrating, as it delays the delivery of the final report to the consumer and it prevents the appraiser from being able to move on to a new order. Not only are revisions a pain, but they are also costly to business in a number of different ways. From excess time spent on corrections to risking your reputation and chance of receiving future business, lacking in quality control processes can lead to many significant damages.

Image Source: https://www.appraisalinstitute.org/assets/1/7/02-QualityControlProducingAppraisalReportsandServices.pdf

According to Fannie Mae, many revision requests arise due to deficiencies in the report such as:

- Appraisal data integrity

- For example, “The appraiser inaccurately represented the condition and/or quality of construction…”

- Comparable selection

- For example, “Comp sale two was considered inappropriate as it was 10 miles away and in a different city…”

- Appraisal adjustments

- For example, “The appraiser made a $10k adjustment for a basement to comp sale one; however, the adjustment was incorrectly applied as it should have been negative and not positive.”

Each of these types of defects can easily be avoided when appraisers use Anow’s Nexus report writing solution to build their reports, and are able to leverage the advanced QC dashboard prior to delivering the final product. Anow comes equipped with tools and resources that enable appraisers to have confidence that they are submitting an accurate data summary. For instance, appraisers using Anow can review documents with an intuitive side-by-side PDF and checklist viewer, where custom items for review can be filtered, approved, or flagged as a warning or in critical condition. Reviewers can work more efficiently with these tools, as no report can be fully approved until a reviewer has approved every single item on the checklist. Another revolutionary feature in the Anow suite of tools is the Smart UAD Assistant in Nexus. Appraisers get real-time prompts as they work through a report to help them validate each UAD compliant field.

The key to efficiency in real estate is valid and accurate data. The data in every final report must be reliable, comprehensive, and scalable. The Anow platform analyzes more than 2,500 data points to validate property data against the appraised property. Why is this important? It eliminates inconsistencies, and identifies and roots out biases that may not have been apparent, ultimately instilling client confidence.

0 Comments