ANOW IS FOR EVERYONE

Transform your lending business with state of the art technology.

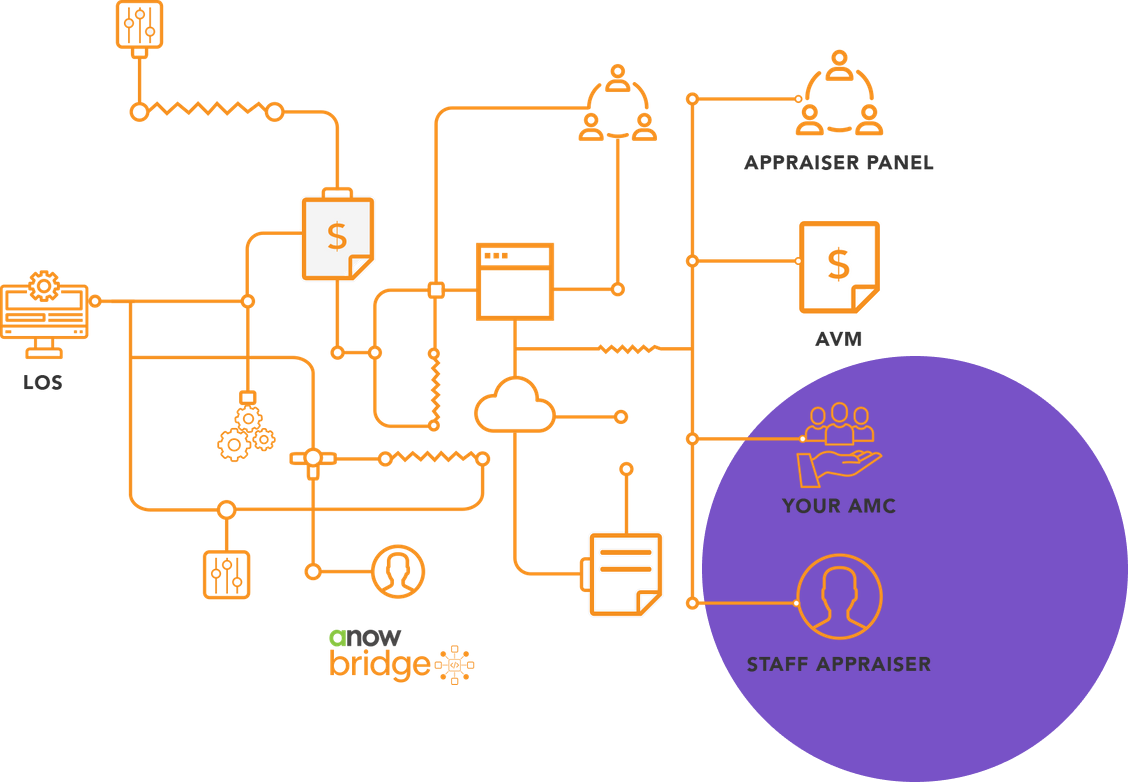

Integrate your LOS, automate order assignment and appraisal review workflows, work with one or more AMCs or your in-house appraisal team, and so much more. Watch your appraisal business flourish with Anow for Lenders.

Out With The Old & In With The New: Automate, Customize, Simplify

Do you want to take your appraisal business to the next level, all while making your life easier than ever before?

For lenders, time is money. Start taking control with Anow.

One thing is for certain: Lenders are busy and every minute is a valuable resource. There’s no time to waste when it comes to finding available assignees, allocating orders, and completing reviews. Regardless of what challenges you face being a Lender and working with appraisers, Anow comes with sophisticated solutions to give you peace of mind.

Save time and money with an end-to-end solution designed for modern-day Lenders who want to take control of their business, and grow in the appraisal industry.

Discover how Anow can help your business

Anow packs powerful tools that can help you manage orders and provide outstanding customer service into one beautiful dashboard. And that’s just the start.

Data Protection Guarantee

You can rest assured that your data will never be compromised or sold. You own your data! Anow’s End User License Agreement protects your business.

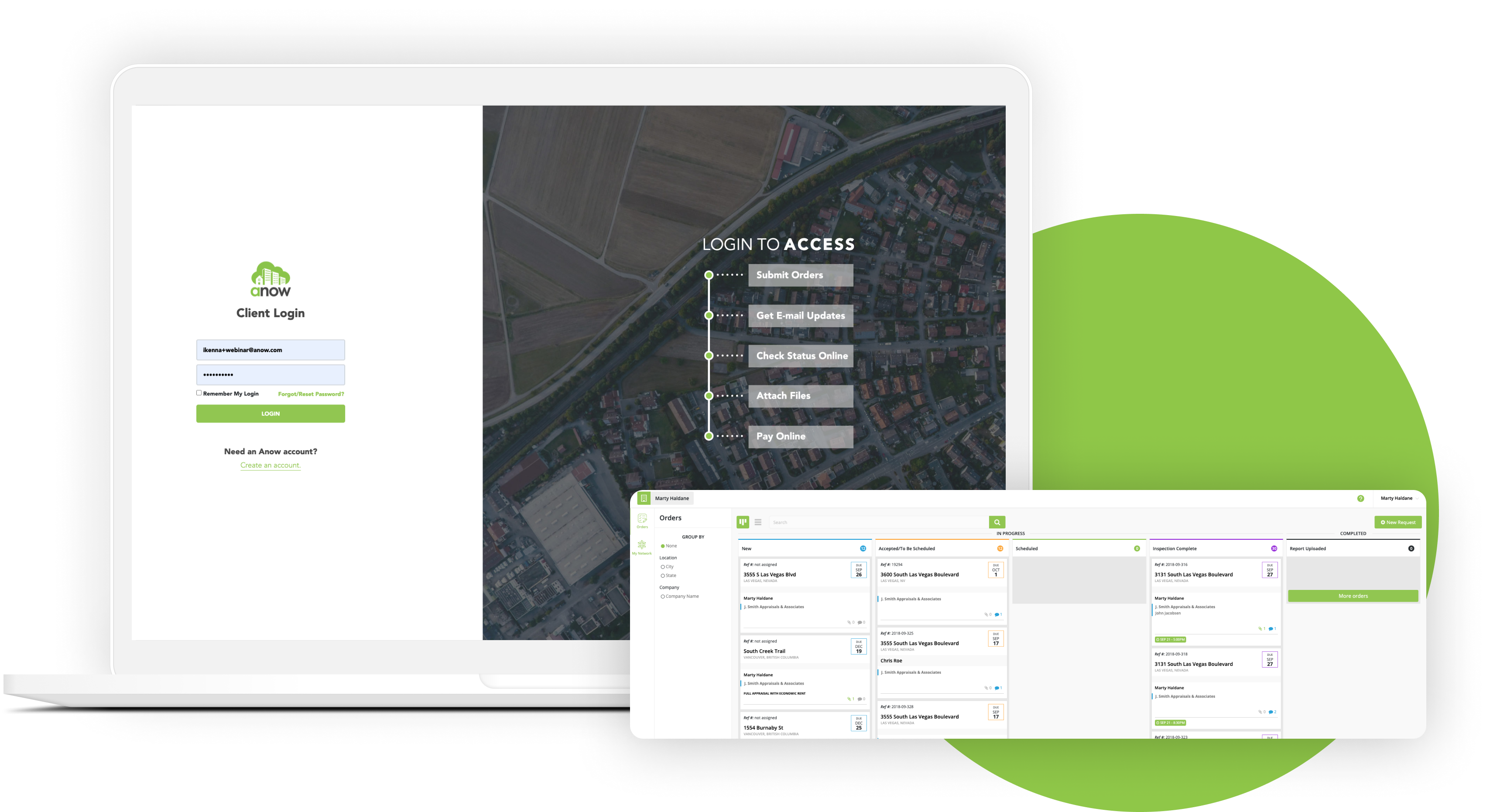

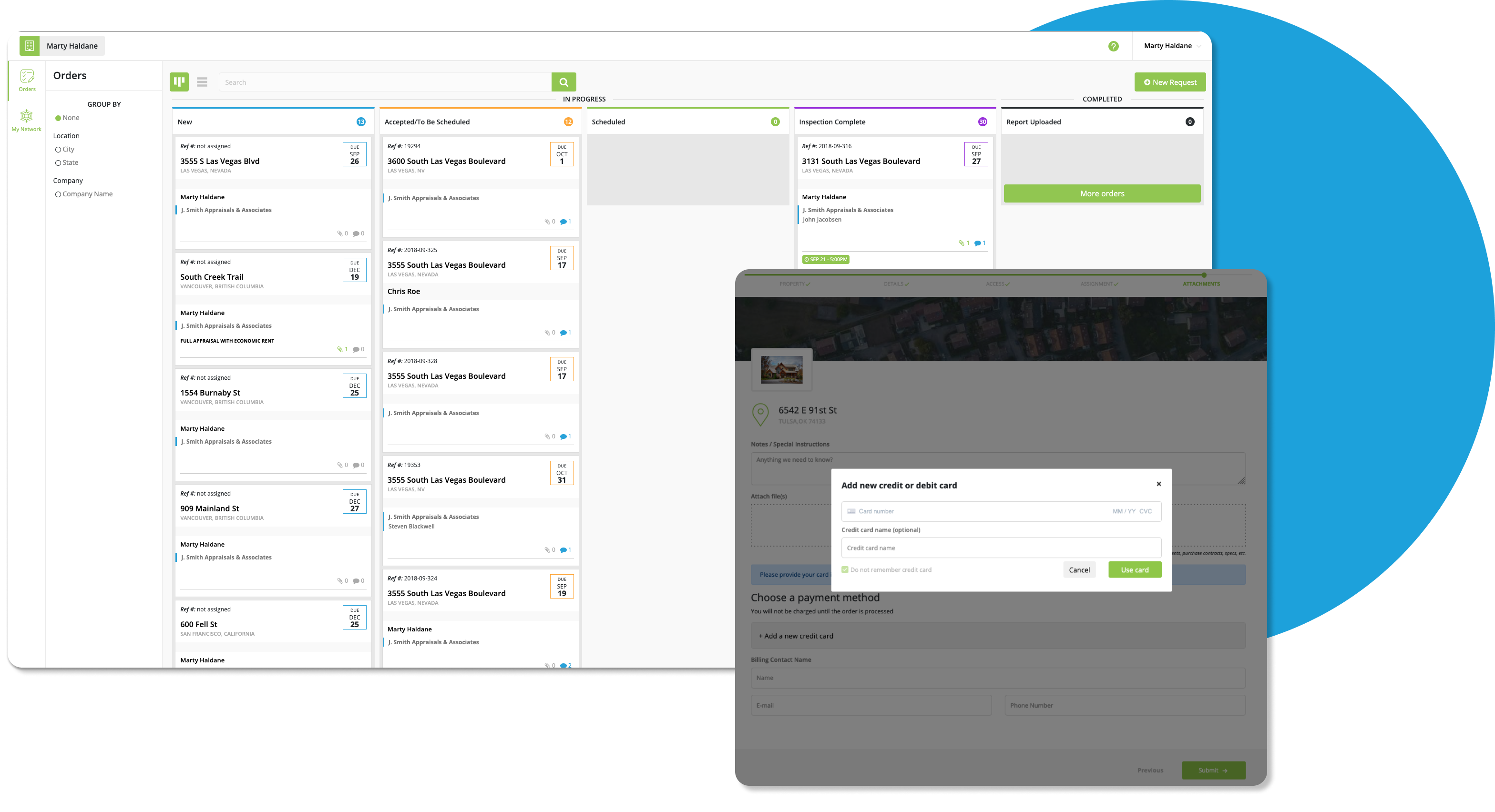

Appealing, Modern Design

Visualize every order status and detail with an easy-to-read kanban board, or choose the order list view. Group appraisals by location or company to find what you’re looking for, fast.

Simplify Panel Management

All AMCs and appraisers you work with live in Anow, along with your appraisal order details. This makes it easy to delegate work and assign the right team for the job.

Whitelabel EVERYTHING

Entirely customized to your brand identity, Anow makes you stand out. Whitelabel everything from the order management system, login pages, to the Nexus report writer. Make your brand known!

Stay 100% Compliant

Built by an experienced development team, Anow allows you to distribute new orders, allocate tasks, and review submissions with confidence all while ensuring compliance.

It’s All Automatic

The goal is to simplify your life, so we’ve taken the liberty of automating all of the important milestone tasks: Order assignment to appraisers and AMCs, Risk Reports are accompanied with every order, billing notifications, appraisal review checklists, and more.

Everything From Your LOS Syncs Directly Into Anow

Manage your orders in a beautifully designed online portal that integrates seamlessly with your LOS.

No matter what Loan Origination System you use, it can be integrated with your Anow account thanks to our advanced API and custom integration capabilities.

Order details and statuses are consolidated in one place for reliable, easy access to all of the information you need.

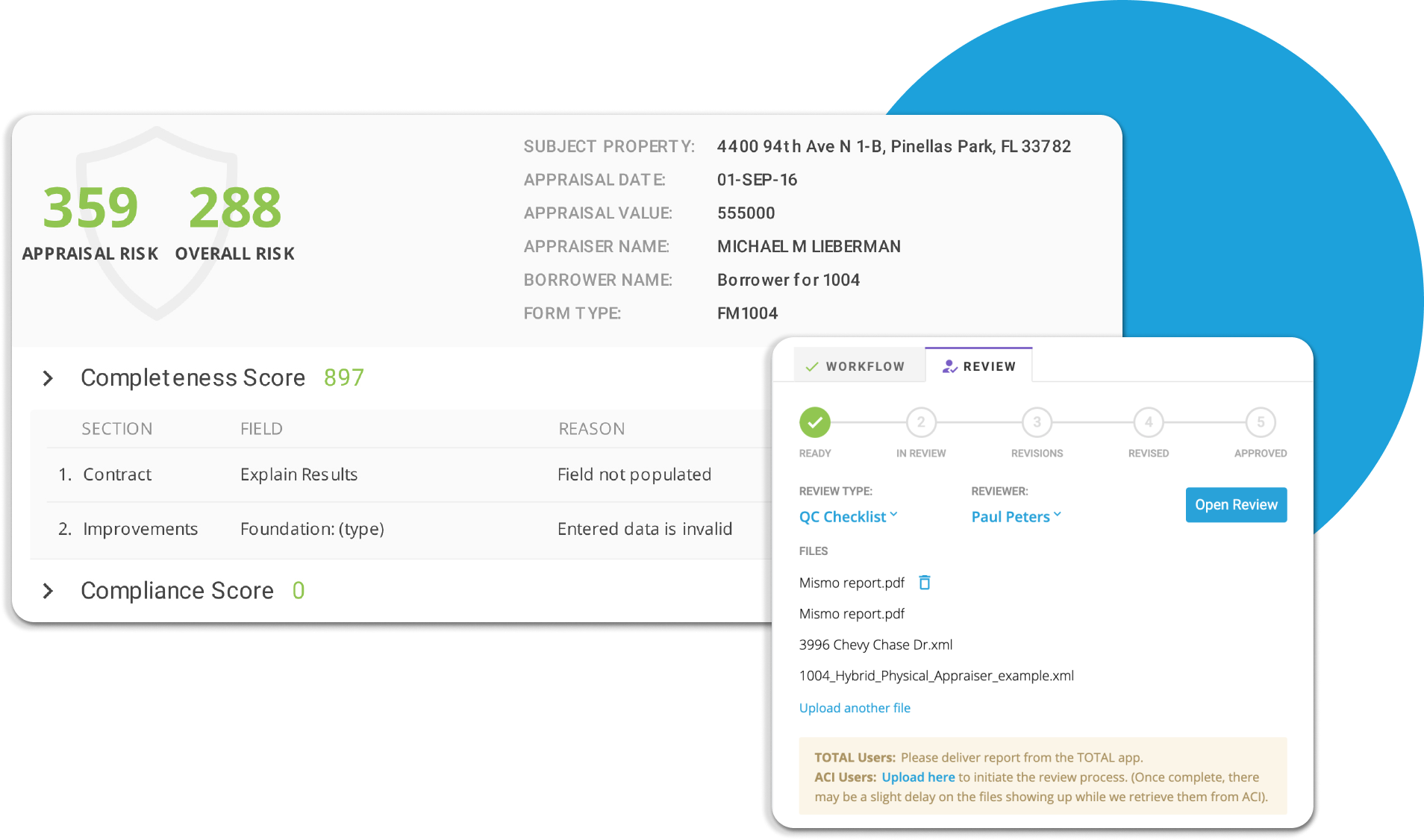

Speed Up The Review Process With Automatic And Custom Rules

The appraisal review process shouldn’t be tedious or time-consuming; you need to be able to focus on delivering a solid product to your customers in a timely manner.

Anow’s automated review features are backed with augmented artificial intelligence to ensure Reviewers can efficiently complete their duties based on the specific rules and requirements you set.

XML files can be uploaded directly into Anow: Learn More.

XML files can be uploaded directly into Anow. This keeps your orders up-to-date (so you’re always in the loop), and allows the assignee to begin the smart review process.

- Protect your reviews and make sure every item is dealt with.

- Organize your reviews with Custom Checklists and Review Rules.

- Review items can be flagged as Approved, Warning, or Critical.

- An intuitive side-by-side PDF and XML Checklist Viewer allows for faster review completion.

Using advanced routing algorithms and automated XML review tools, full appraisal reports can be delivered back within 48 hours of ordering.

Make your appraisal reviews easier, faster, more accurate, and better organized.

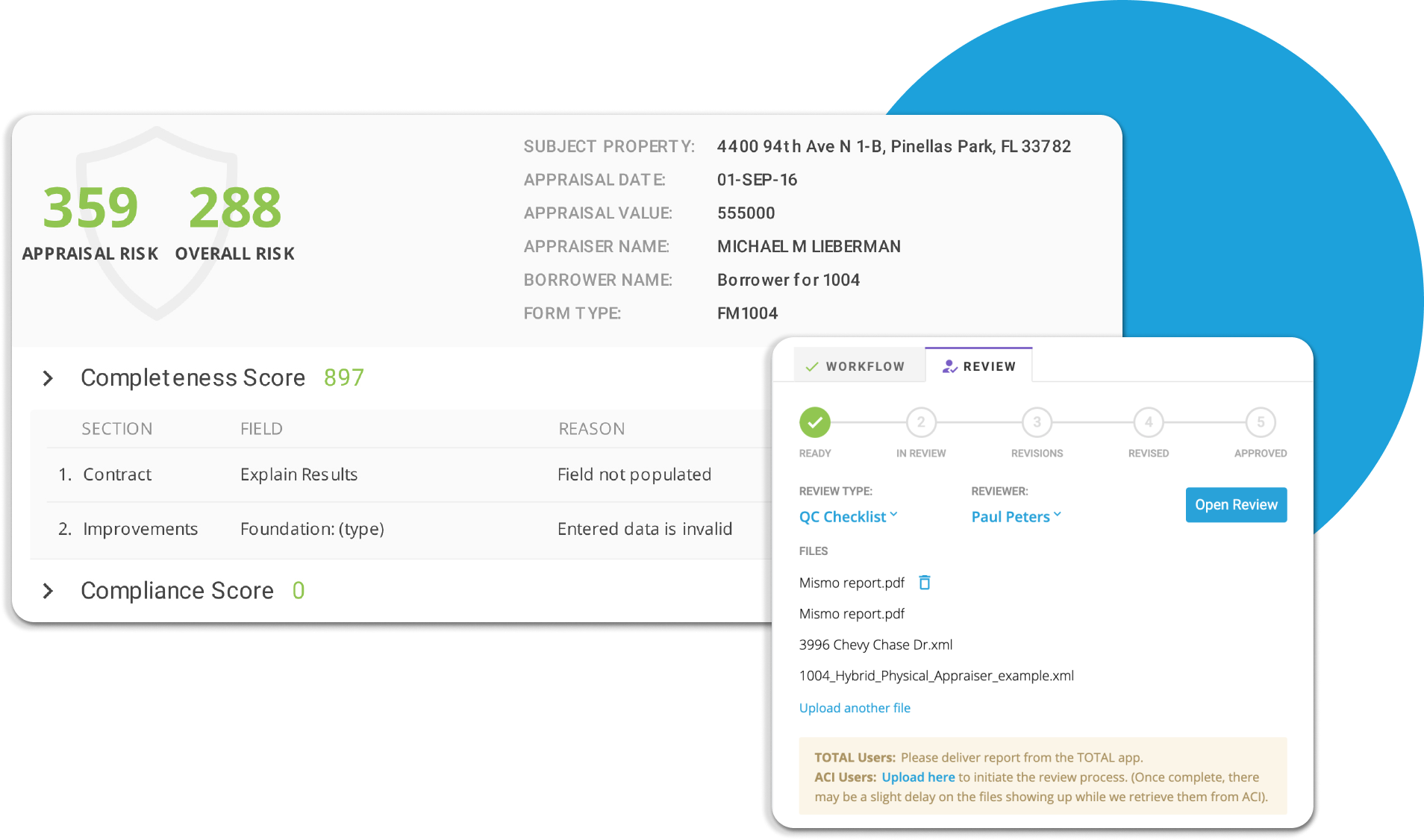

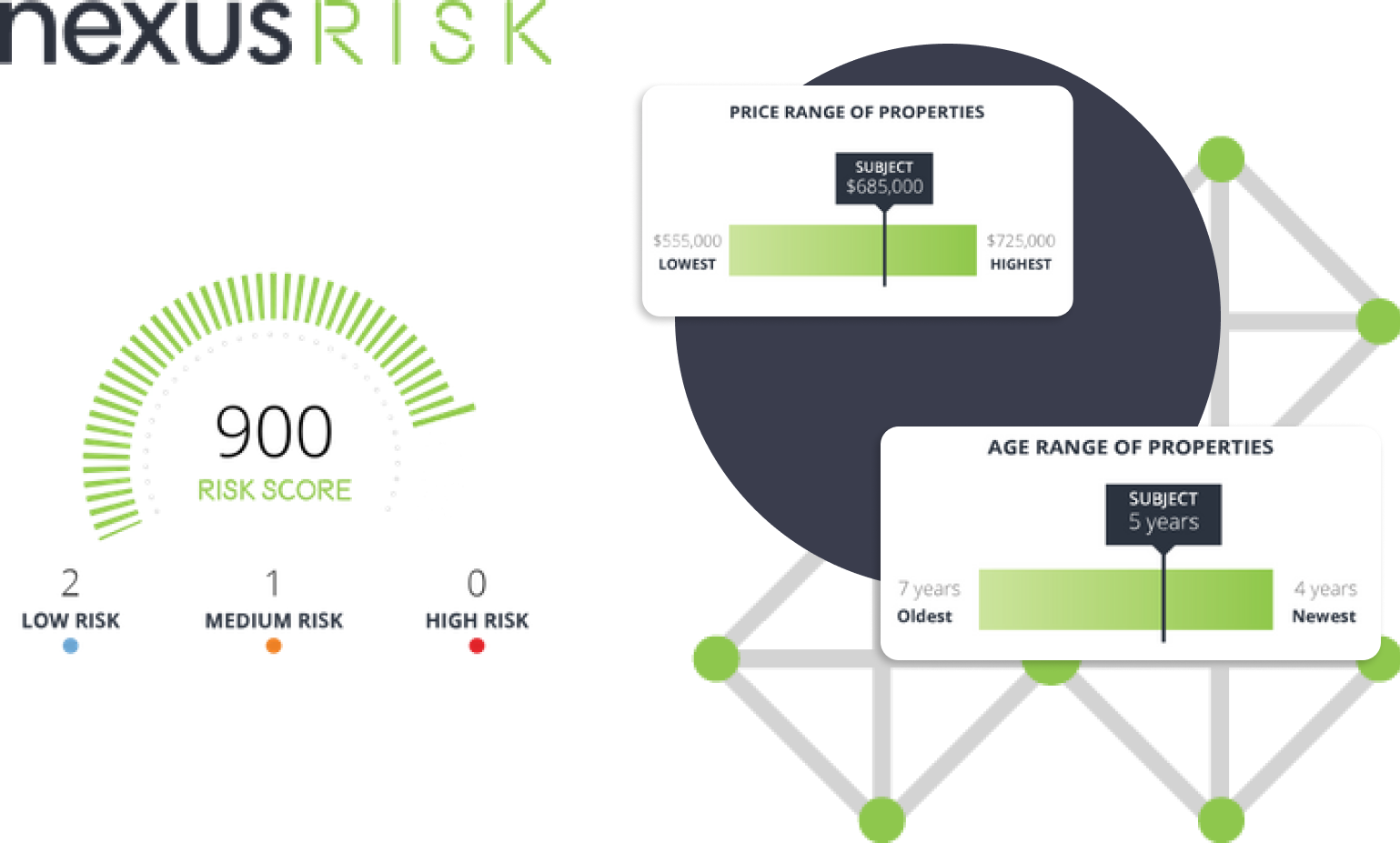

Get Compliant Executive Summaries With Every Appraisal Report

Could you benefit from having an overview of the overall risk, compliance score, and integrity score on each appraisal you process?

A Nexus Risk Review Report comes with every appraisal by default – there’s nothing extra you have to do! This detailed report is fully compliant and outlines potential risks and raw JSON property data sent back through Anow Bridge.

These automated order review reports includes the following:

- Appraisal Risk Score

- Overall Risk Score

- Completeness Score

- Compliance Score

- Appraisal Methodology

- Conformity Score

- Integrity Score

- Valuation Risk Score

- Comparables Risk Score

Be aware of any risks and compliance issues prior to submitting the final report to your client; request adjustments and revisions where necessary to make sure the end product is bulletproof.

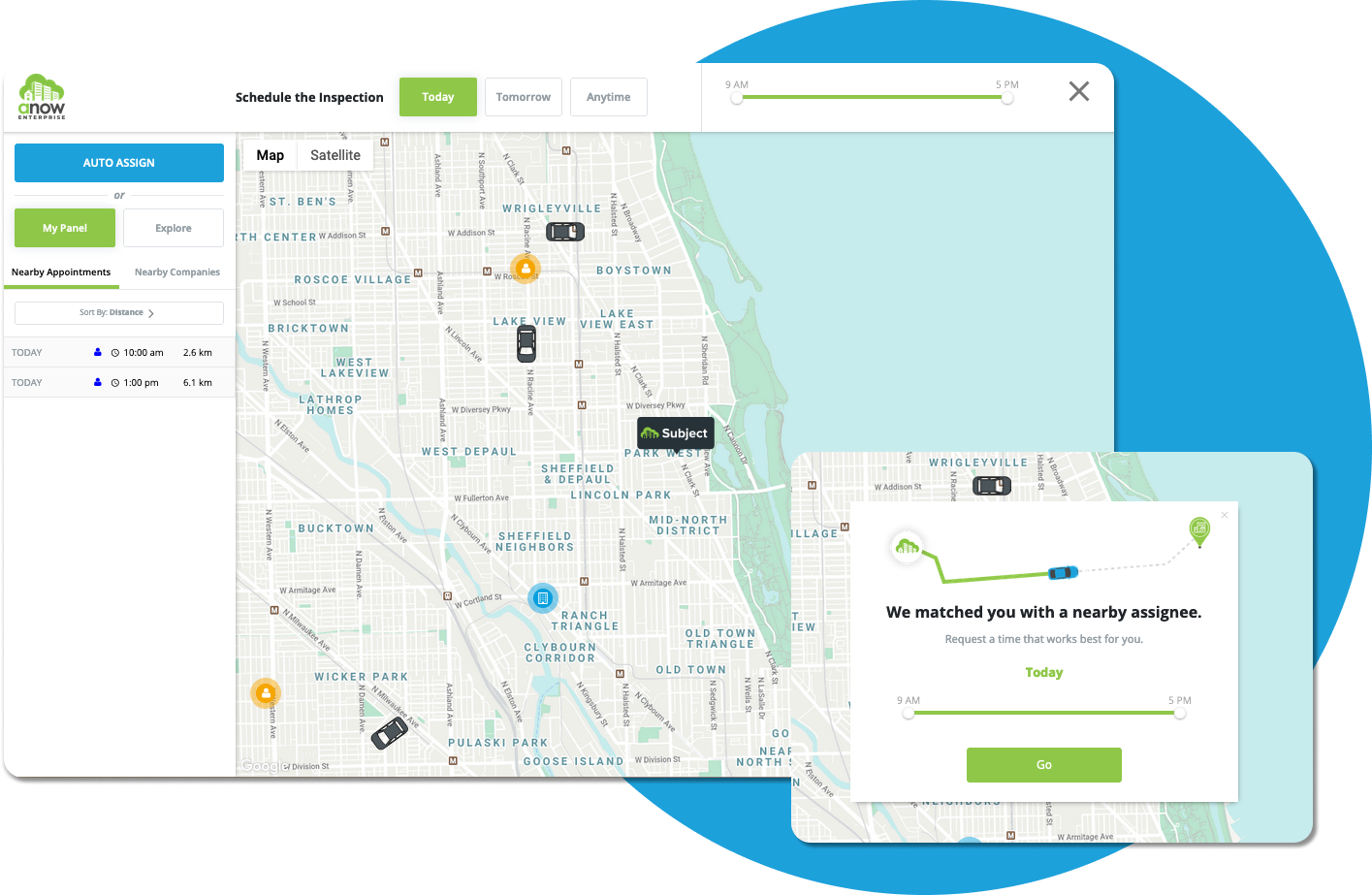

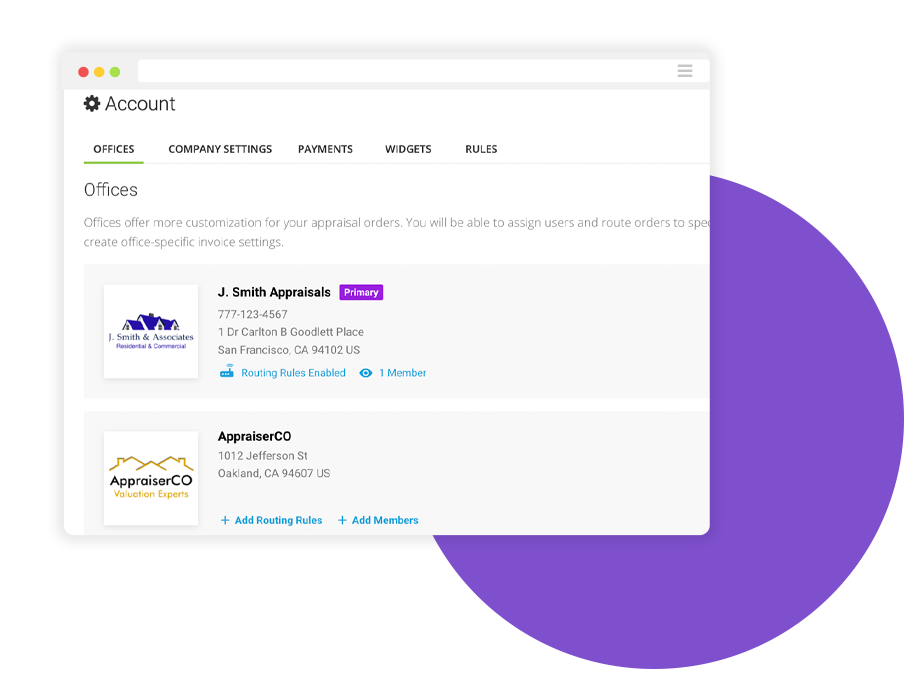

Manage Your Appraiser Panel And AMC Orders

You have the power to choose who you work with, and how.

Anow is designed to work with you and your needs. Regardless of who you work with, Anow lets you efficiently manage workflows from order assignment to final report delivery.

Efficient solutions for in-house appraisal teams and AMCs

When a new appraisal is requested you can assign it automatically to your in-house appraisal team online, and all the critical details will be provided for them. This gives your appraisers the ability to start working right away and ultimately reduce turn times. Being equipped with the full order details also gives your team the confidence they need to deliver relevant reports with accurate findings.

If you work with one or more AMCs, you can do that too! You can even assign orders out to a national panel of appraisers if you don’t have a regular contact to complete the request.

Source appraisers, manage your in-house team, work with multiple AMCs and assign with ease.

Smart Online Payment Processing Portal

Process credit card payments from Borrowers and customize when funds are collected based on your workflow notifications.

When an appraisal is ordered, credit card information can be stored on the order request page in Anow Connect.

Bonus! Everything in Anow Connect including your order portal, login pages, online order form, and payment links can all be whitelabelled.

Billing notifications will automatically be sent to the Borrower when an order has been submitted, but now you can personalize the notifications they receive.

- How are the notifications sent (text and/or email)

- When the reminders will be sent

- When to stop collecting and sending reminders

Grow your appraisal management company with Anow

Get a FREE 30 day trial of Anow and Anow Accelerate.